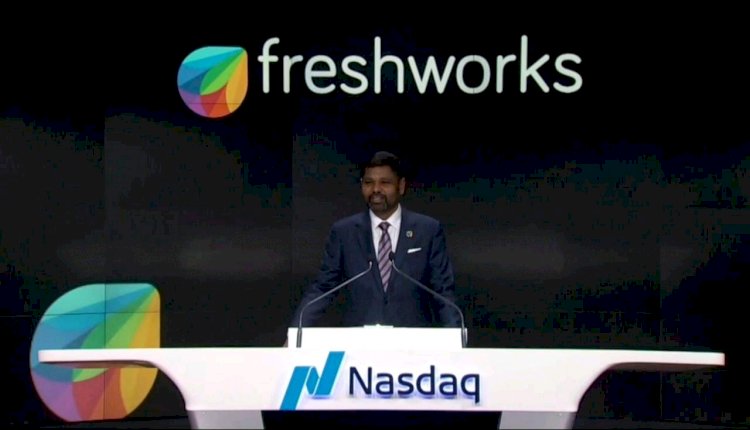

Freshworks IPO Gets More Indians to Enter US Markets

Investment queries rose in the run-up to the offering, according to Viram Shah, co-founder, and CEO of Vested Finance

Freshworks, the first Indian products company to list on the Nasdaq, saw Indian investors spend over USD600,000, or INR 5 crore, into the IPO in the first two days on platforms including Stockal, Vested Finance, and Scripbox.

Apart from the joy on social media, ‘FRSH' was the top trending stock in terms of buying and search volumes last week, outperforming Tesla and Microsoft. According to reports, many first-time investors from India, primarily techies and members of the startup ecosystem, opened new accounts to invest in Freshworks.

Investment queries rose in the run-up to the offering, according to Viram Shah, co-founder, and CEO of Vested Finance. Over INR 2 crore has been invested in the Freshworks stock to date, and it was the platform's top stock in the first three days of listing. There was also a 50 percent increase in the number of new accounts created by users, mostly for the purpose of investing in Freshworks.

Calls across support platforms enquiring about investing in Freshworks were up 30-40% on the day it went public, according to Stockal co-founder and CEO Sitashwa Srivastava. The Freshworks stock has received over USD300,000 in investment. He went on to say that the tech industry accounts for over 70% of the investment, with the majority hailing from Bengaluru, Chennai, and other southern cities.

According to Scripbox's chief business officer, Prateek Mehta, the search volume for Freshworks has skyrocketed. Given that it has only been three days, he anticipates that more people will discover it shortly and that performance will improve.