India Water Purifier Market Size More Than Triples to Cross USD 3.7 Million by 2029

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the India water purifier market size at USD 1,041.5 million in 2022. During the forecast period between 2023 and 2029, BlueWeave expects the India water purifier market size to grow at a robust CAGR of 17.35% reaching a value of USD 3,731.63 million by 2029.

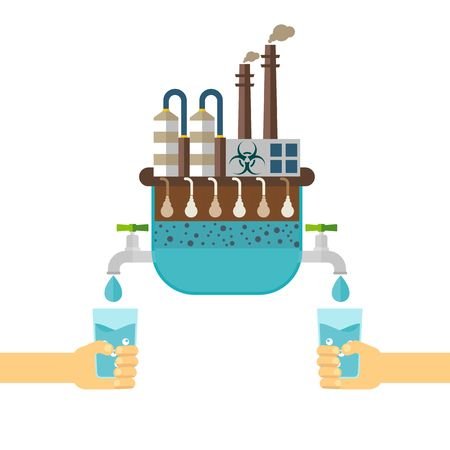

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the India water purifier market size at USD 1,041.5 million in 2022. During the forecast period between 2023 and 2029, BlueWeave expects the India water purifier market size to grow at a robust CAGR of 17.35% reaching a value of USD 3,731.63 million by 2029. The growth of the India water purifier market is fueled by the increasing awareness of waterborne diseases and the need for safe drinking water. Rising concerns over water pollution, scarcity of fresh water, and a surge in urbanization have further driven the demand for water purification systems. The government's initiatives to promote access to clean water and the availability of technologically advanced and affordable water purifiers have also played a pivotal role in propelling the expansion of the market. As consumers prioritize their health and seek reliable solutions for clean drinking water, the India water purifier market continues to experience significant growth and presents lucrative opportunities for the players in the industry.

Opportunity: Increasing demand for water purification systems

The increasing demand for water purification systems in India is paving the way for lucrative opportunities in the growth of the water purifier market. The rising awareness of waterborne diseases and the need for safe drinking water, coupled with growing concerns over water pollution and the surge in urbanization, are driving the adoption of water purifiers across the country. Government initiatives to promote access to clean water and the availability of technologically advanced and affordable water purification solutions further amplify the market's potential. With a large and diverse population, the Indian market offers a promising landscape for water purifier manufacturers to capitalize on this escalating demand and cater to the critical requirement for safe and potable water in households, commercial establishments, and industries.

Sample Request @ https://www.blueweaveconsulting.com/report/india-water-purifier-market-1857/report-sample

Impact of COVID-19 on India Water Purifier Market

The COVID-19 pandemic had a significant impact on the water purifier market in India. On the one hand, the heightened awareness of the importance of clean drinking water for maintaining health and hygiene has driven increased demand for water purifiers. However, supply chain disruptions and economic uncertainties posed challenges, affecting the water availability, and purchasing decisions. The shift to online shopping and the focus on personal health led to an upswing in e-commerce sales. As the situation evolves, the market is expected to rebound, driven by continued consumer prioritization of health and the need for safe drinking water in homes and workplaces.

Segmental Information

India Water Purifier Market - By Distribution Channel

Based on the distribution channel, India water purifier market is divided into retail distributors, online suppliers, and direct-to-consumer segments. The online supplier segment is expected to grow at the highest CAGR during the forecast period. The increasing popularity of e-commerce platforms and the convenience they offer to consumers have led to a surge in online purchases of water purifiers. Online suppliers provide a wide range of options from various brands, making it easier for consumers to compare products, read reviews, and make informed decisions. The availability of attractive deals, discounts, and doorstep delivery options further enhances the appeal of online shopping. As more consumers prefer the convenience and accessibility of online channels, the online suppliers segment continues to be a major driving force behind the market's growth in India.

India Water Purifier Market – By Region

On the basis of region, India water purifier market is divided into North India, South India, East India and West India. South India is expected to be the fastest growing region in the India water purifier market by region. The region's rapid economic development, urbanization, and increasing awareness about waterborne diseases have led to a surge in demand for water purification systems. The growing urban population, coupled with a rise in disposable incomes, has fueled the adoption of water purifiers in households, commercial establishments, and industries. Additionally, government initiatives and environmental concerns regarding water quality have further accelerated the market's expansion in South India. As a result, the region's dynamic growth trajectory makes it a significant force in propelling the overall growth of the India water purifier market.

Competitive Landscape

The India water purifier market is fragmented, with numerous players serving the market. The key players dominating the India water purifier market include Hindustan Unilever Ltd, Ion Exchange, Tata Chemicals Ltd, Kent RO Systems Ltd, Hi-tech RO Systems, Godrej Industries Ltd, Panasonic Corporation, Livpure Private Ltd, EsselNasaka, Whirlpool India Ltd, and Havells India Ltd. The key marketing strategies adopted by the players are facility expansion, product diversification, alliances, collaborations, partnerships, and acquisition to expand their customer reach and gain a competitive edge in the overall market.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662